COMMUNITY HOUSING RISK SCHEME

The Community Housing Risk Scheme is a discretionary trust/scheme providing its members with protection for their physical assets. Integrating specialised claims and risk management systems with industry design and focus.

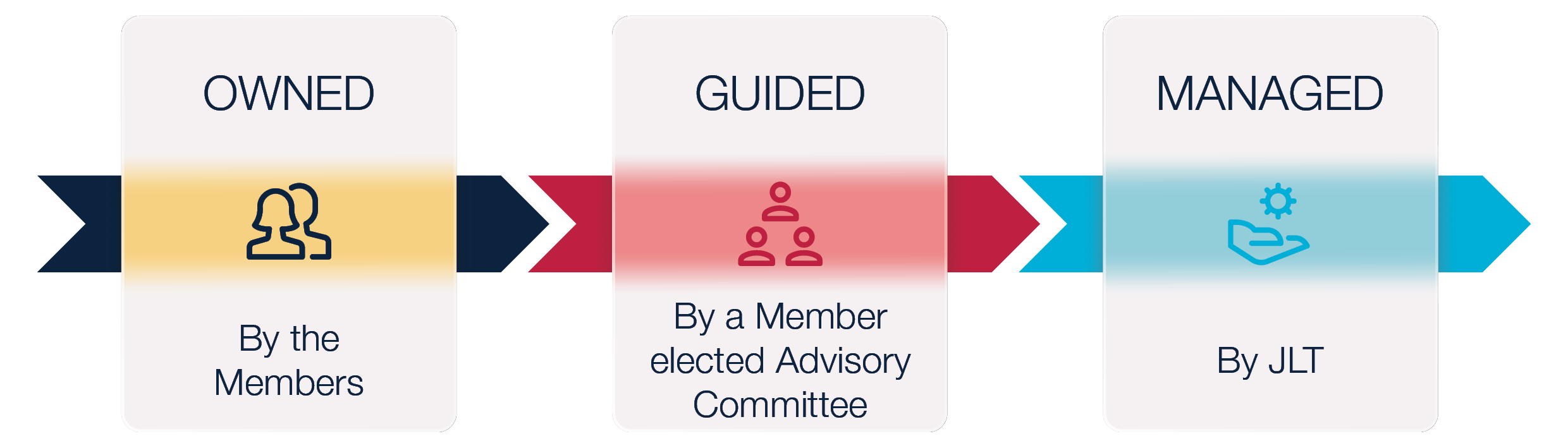

The Scheme empowers Members to take greater control of the costs involved in protecting their physical assets.

We are a ‘self-insurance scheme’ which is backed by reinsurance placed through local and international underwriters. Members own the Scheme and benefit from building equity resulting from surplus contributions.

Members of the Community Housing Risk Scheme are provided with:

- Cost-effective protection of assets

- Risk management services and programs

- Specialised claims management support

- A Scheme approach that supports positive financial outcomes and minimises the effect of external influences

- Reinvestment and returns of surplus

JLT - SCHEME MANAGER

JLT Risk Solutions (JLT) is the appointed Scheme Manager (and trustee) of the Community Housing Risk Scheme. JLT is a market leader in the provision of risk and protection services administering self-insurance Schemes across all states which comprise over 450 entities Australia wide.

ASIC requires licences to be held by issuers/administrators of such schemes in order to:

- Provide financial product advice

- Issue the interests in a Scheme/discretionary trust

- Manage claims (if on behalf of insurers)

JLT differentiates itself from the market by holding the requisite licence authorisations enabling a whole of risk approach to Scheme management.

The services provided to the Scheme include insurance broking and advice, claims management services and risk consulting. JLT also has access to the wider Marsh McLennan services which include valuations, analytics and natural catastrophe modelling teams.

Click Here for more information about JLT Risk Solutions.